Talent is your city's best insurance policy

Economic resilience is ultimately about people and the skills they possess.

What makes some cities resilient to sudden economic shocks and others not?

Policymakers across the world are chasing varying notions of economic resilience, spurred on by pandemic-era supply chain woes and a deeper reckoning with deindustrialization in developed economies. National governments are revisiting old industrial policy and protectionist frameworks, seeking to duplicate key supply chain nodes at home or within allied trade blocs. Tariffs, local content requirements, and massive corporate subsidy schemes are back in vogue.

Yet for mayors or city-level leaders looking to make their region’s economy more resilient to trade or geopolitical shocks, there isn’t a readymade playbook. Economic diversification is an obvious answer, but prescribing this is a bit like just restating the ailment. Coordinating public investments in emerging sectors that fit with a city’s existing strengths might make sense, but this also requires a high degree of state capacity to execute well.

A recent working paper from economists Luisa Gagliardi, Enrico Moretti, and Michael Serafinelli suggests that maybe the mere accumulation of talent is the best insurance policy a city can buy.

Gagliardi, Moretti, and Serafinelli (henceforth GMS) examine nearly two thousand regional economies across six countries—France, Germany, Great Britain, Italy, Japan, and the United States—tracking the rise and fall of manufacturing hubs over the late 20th century.

GMS identifies the year in which manufacturing employment peaked in each country. The authors then take the top third of each country’s cities in manufacturing employment share in that year and designate those places as manufacturing hubs, whose trajectories they then trace through the subsequent era of deindustrialization.

On average, manufacturing hubs were hit quite hard by deindustrialization, which began as early as the 1970s in the United States and Britain and as late as the 1990s in Japan and Germany. GMS finds that a one standard deviation increase in a city’s manufacturing employment share corresponds with overall employment growth 2.71 percent lower in each subsequent decade. As you would expect, a shock to Western manufacturing sectors wreaked the most long-term havoc on those regions specializing in manufacturing.

But not all former manufacturing hubs went the way of Detroit, falling victim to a doom loop of population decline and perma-stagnation. Instead, GMS finds that 34 percent of former manufacturing hubs fully recovered, defined as ultimately returning to or exceeding national rates of employment growth.

The rate of manufacturing hub recovery varied quite dramatically between countries: in Germany, 47 percent of manufacturing hubs bounced back from the shock of deindustrialization to return to Germany’s national growth trajectory. In the United States, just 17 percent rebounded, the lowest rate of the countries examined. Narrowing the sample further to only those cities in the top 20 percent of manufacturing employment share in each country reveals an even grimmer picture for American hubs. Whereas 29 percent of all top quintile manufacturing cities recovered across the countries examined, only six percent of top quintile hubs in the U.S. ultimately bounced back. In other words, those U.S. cities most heavily specializing in manufacturing at the country’s industrial peak around 1970 almost universally failed to catch back up to the national growth trend. This helps explain in part why American economic geography is so strongly bifurcated between a handful of superstar metro areas and the rest of the country.

The authors identify a strong and accelerating relationship between cities’ initial levels of human capital at their country’s industrial peak and subsequent economic performance. Across all cities (not just manufacturing hubs), the authors calculate that a one standard deviation increase in the share of workers with a college degree resulted in 9.1 percent faster employment growth per decade.

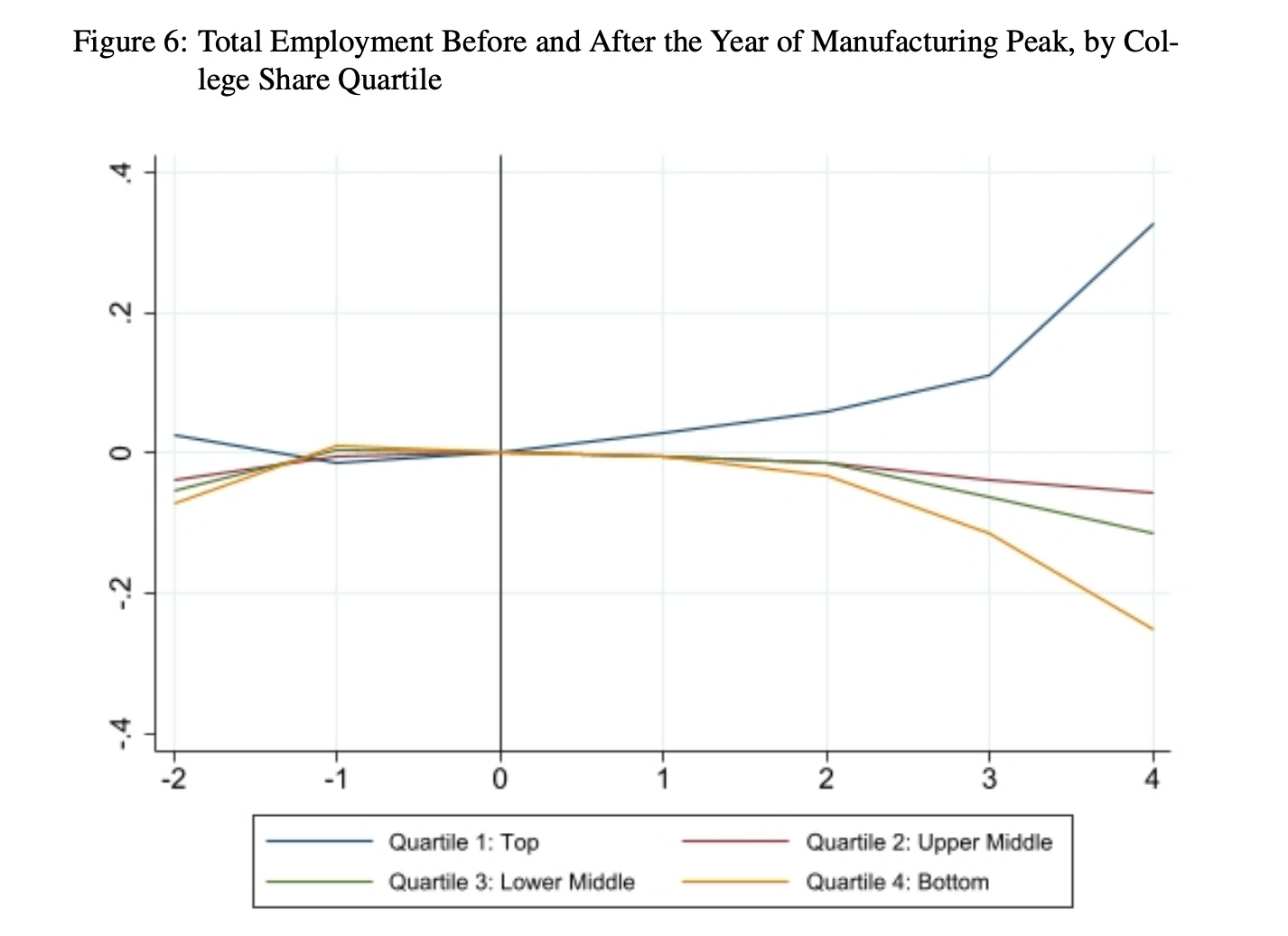

What is notable here is how little college completion rates seemed to matter before deindustrialization. Cities with high college shares grew no faster than cities with the lowest rates in the decades before manufacturing began to decline in each country (denoted as year zero in the chart below). Only after deindustrialization began did the initial presence of college graduates begin to matter, and it grew more important as time went on.

There is a concern that initial levels of human capital and a city’s propensity to rebound from deindustrialization may be endogenous—subject to reverse causality. Perhaps, for instance, before the decline of manufacturing began, college graduates could foresee which cities were likeliest to grow and moved there. GMS allays these concerns by using cities’ distance from older nearby colleges—whose locations are unlikely to systematically correlate with economic shocks to manufacturing decades later—as an instrument for cities’ college graduate shares at manufacturing’s peak.1

Using this approach, GMS finds that in historic manufacturing hubs, a one percentage point increase in the share of workers with a college degree before deindustrialization began is associated with a 2.4 percentage point increase in subsequent per-decade employment growth. In other words, the presence of college graduates is what separated those manufacturing hubs which recovered from deindustrialization from those that did not.

Why did American manufacturing hubs perform so poorly? One likely reason is that the college degree gap between manufacturing hubs and non-hubs was greatest in the United States than in other industrialized peers. Their initial, (relatively) low levels of human capital made them uniquely vulnerable to trade shocks and less adaptable than peers in other countries.

Talent = Resilience

Cities can hedge against harmful economic shocks by being relentless about attracting and cultivating talent, a task no less important in periods of prosperity. Those manufacturing hubs which had a ready supply of smart and flexible skilled workers were quickly able to shift to the next thing as soon as heavy industry packed up and moved overseas. They remained attractive places to invest and the non-linear returns to clustered talent gave them a distinct advantage in sprouting new ideas and new firms. Meanwhile, those cities whose workforces and policy environments were entirely focused on meeting the needs of industrial mega-plants found themselves unable to adapt.

At manufacturing’s peak, the presence of college graduates didn’t appear to matter much to cities’ fates; indeed, there is no real relationship between employment growth and the share of local workers with a degree pre-deindustrialization. Yet while this reserve of human capital may not have been immediately valuable, it served as a highly effective insurance policy for those cities who built it.

It is important to remember that the measure used here, local college degree attainment, is merely a quick, available proxy for talent. You do not have to believe that more local students should be attending traditional colleges to understand the link between human capital and your city’s resilience to economic shocks. A 21st century agenda to better cultivate local talent might send students through a diverse array of alternative pathways, fellowships, or incubators. At the same time, it might also include measures like the Heartland Visa, which would attract skilled workers and entrepreneurs from abroad to pockets of the country suffering from economic and demographic decline, perhaps independent of their educational credentials.

Massive economic disruptions akin to the China Shock will happen again. They may just topple some of today’s superstar cities. Their shape and extent will be hard to predict, and explicit planning to avoid them can only go so far. Just as in the past, those places which adapt to these shocks will be those who attract the best and brightest, while those who rest on their laurels will watch them crumble beneath.

For the non-wonks, some help from ChatGPT: Instrumental Variables (IVs) are used in statistics to untangle cause and effect in situations where this is difficult due to endogeneity—when both the cause and the effect influence each other or are influenced by outside factors. Imagine we want to understand if education (X) leads to higher earnings (Y). However, natural ability (U) might affect both education and earnings, making it hard to isolate the effect of education alone. An IV is something that affects education but not earnings, except through education. For example, the distance to the nearest college (Z) might influence a person's education level but not their earnings directly. In a simple diagram:

Distance to College (Z)→Education (X)→Earnings (Y)

Natural Ability (U)→Education (X) and Earnings (Y)

The IV method uses the relationship between Z and X to understand the impact of X on Y, bypassing the influence of U. This helps us get a clearer, less biased estimate of how education affects earnings.

"Why did American manufacturing hubs perform so poorly? One likely reason is that the college degree gap between manufacturing hubs and non-hubs was greatest in the United States than in other industrialized peers."

Why would this be, though? This seems like a central question. Perhaps the US, because it is larger than most counties, has a more unequal dispersion? But I wonder if the role the US dollar plays in international trade matters. Unlike German or Japanese currency, demand for USD has been very high and so many countries have built export-driven economies that sell goods to the US in exchange for dollars. Perhaps, the demand for dollars undermined US manufacturing more than it otherwise would have been?